It was exactly a year ago that I wrote a blog called “Housing Will Save US”.

I had been BLOGGING about all the good news relative to housing statistics both locally & nationally for guite some time now. I predicted that a housing boom would help to pull this nation out of it’s Great Recession and that’s exactly what happened. While governments and corporations went on a belt tightening mission by decreasing staff—costs—in order to boost profits, the housing sector was growing from the foundation up. Literally and figuratively.

Locally, our economies have enjoyed a healthy steady growth through all facets of housing and the ancillary services housing supports. From landscapers to framers, all report an uptick in business. While the jobs may be on tighter margins, at least there are jobs to report. Nationally, the same has held true.

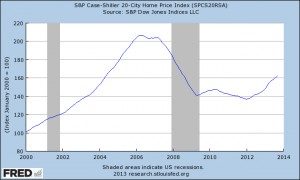

This trend is poised to continue as the October report on US Building Permits hit the highest since June 2008 with 1.034 million permits issued—a 6.2% increase from September, which was a 5% increase from August. The trend is set. Now the S&P/ Case-Shiller Index on US Home Prices in September realized the highest gains since February 2006, over 7 years ago, with a 13.3% rise year over year in September.

We’ve all listened to the experts say the rise in building permits was so great due to multi-family homes, so should not be counted as so great. How silly— what ever form of housing is under demand, that is the void that builders fill. And Professor Shiller cautioned us that the price spike was due to institutional buyers of single family homes… with all very well earned respect sir, 100,000 institutional purchases over the millions sold does not make me gasp!

We’ve all listened to the experts say the rise in building permits was so great due to multi-family homes, so should not be counted as so great. How silly— what ever form of housing is under demand, that is the void that builders fill. And Professor Shiller cautioned us that the price spike was due to institutional buyers of single family homes… with all very well earned respect sir, 100,000 institutional purchases over the millions sold does not make me gasp!

Bottom line…Housing remains the American Dream.

It provides one of the 3 essentials in life—shelter— Home values took the greatest hit since the Great Depression after the collapse of Lehman and now we are all wiser for it.

That’s not to say there are not bubbles that form in certain segments of markets with in markets. Whenever you have a market driven by a specific niche set of buyers it’s a fragile market. It has happened before and will happen again, but the scale on which our last correction was denoted will not be seen in our lifetime.

Slow and steady wins the race…. We are just enjoying a little sprint after a long rest!